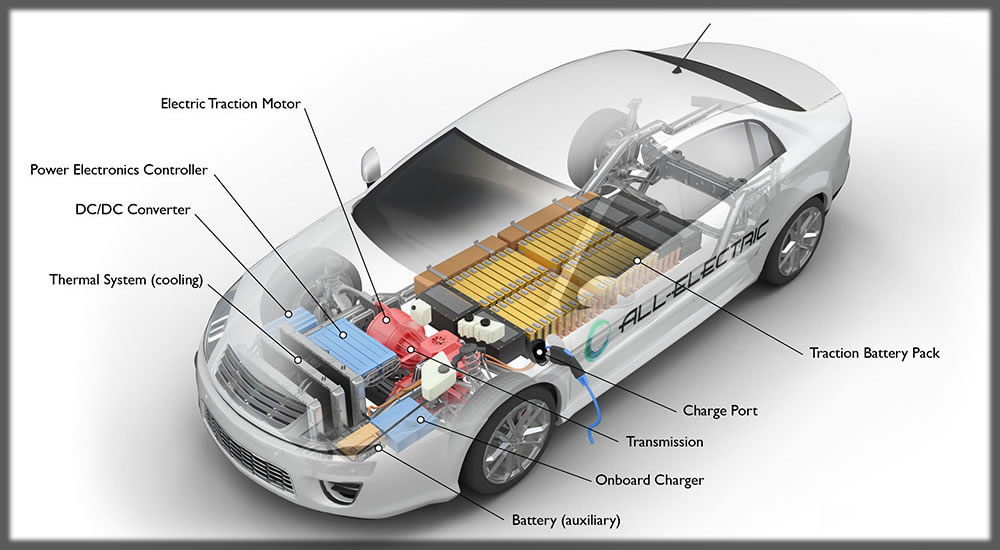

The Role of Government Incentives in EV Adoption. Electric vehicles (EVs) have gained a lot of traction in recent years with an intention to reduce carbon emissions, save fossil fuels, and provide a cleaner and cleaner source of transportation. In spite of such positive factors, the widespread use of EVs has been challenged with several impediments, including high upfront costs, lack of charging infrastructure, range anxiety, and slow transition of the automotive industry. To promote EVs’ use and encourage buyers to switch over from traditional gasoline and diesel-powered automobiles, governments across the globe have adopted a variety of incentives, including financial incentives, tax credits, investments in infrastructure, and legislation. Incentives have a key role in supporting access and demand for EVs for individual buyers and companies alike.

Financial Incentives and Tax Credits

One of the most effective tools governments have for spurring use of EVs is financial incentives in the form of purchase subsidies, tax credits, and rebates. By reducing the high purchase price of EVs, such incentives counteract a long-standing deterrent to widespread use.

In the U.S., the national government grants qualified EV buyers a $7,500 tax credit, and most state governments grant additional incentives, lowering its price even further. Several states even grant rebates at the point of purchase, such that EVs become less costly initially. European countries like France, Germany, and the Netherlands grant very supportive financial incentives to buyers of EVs, with subsidies that can drop an electric car’s price several thousand euros. Norway, a worldwide EV sales leader, exempted EVs from VAT and customs taxes, and therefore, EVs become price competitive with gasoline-powered cars.

China, the world’s biggest EV market, implemented an aggressive subsidy program to encourage the sale of electric vehicles. Both consumers and manufacturers are offered direct financial incentives in an effort to render EVs a viable option. With the maturing of the EV market, China began phasing out subsidies, pushing manufacturers to be competitive and less reliant on government incentives.

Tax Exemptions and Reduced Costs of Ownership

Apart from purchase incentives, governments in most countries grant additional discounts and exemptions for taxes to make EVs an economically viable alternative for car owners. Road taxes, car registrations, and even car insurance have discounts and exemptions for EVs in most countries. In Norway, for example, EV owners pay less for tolls, have free trips in ferries, and can use bus lanes, and therefore, EVs become a convenient alternative. In most locations, lowered tariffs for parking for EVs make them even a preferable alternative for use.

Governments also implement lowered tariffs for charging EVs, with owners benefiting in terms of reduced operational costs when compared with traditional gasoline or diesel automobiles. By minimizing the overall cost of an EV, such incentives cause even more buyers to make a switch to an EV.

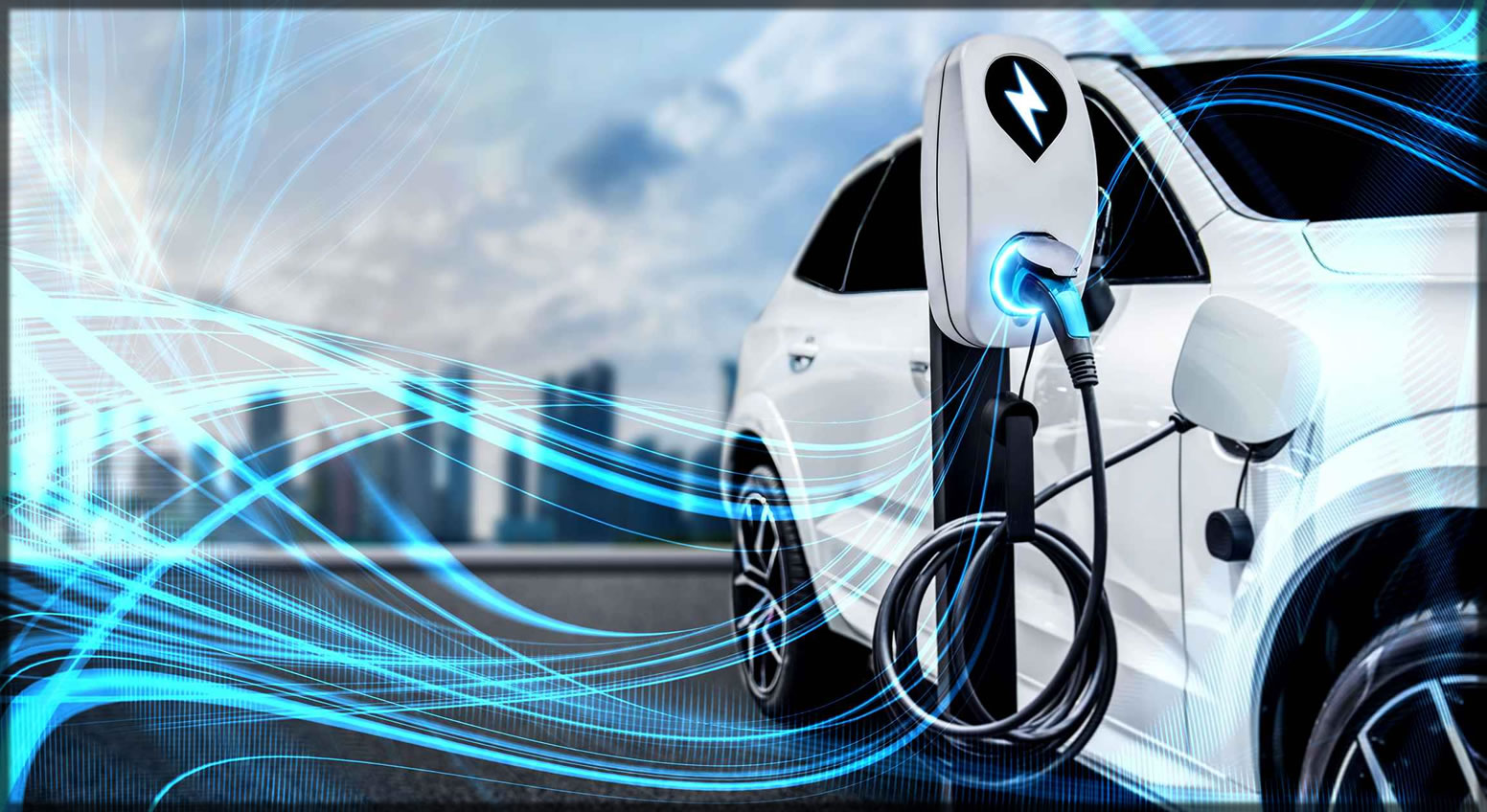

Investment in Charging Infrastructure

An extensive charging infrastructure is critical for widespread use in the mass market for EVs. One of the factors for not yet taking up electric cars, according to potential buyers, is uncertainty over availability and ease of access to charging points, or “range anxiety.” To address this, governments actively contribute to financing and supporting the development of both private and public charging networks.

Countries like France, Germany, and the UK have invested billions of dollars in developing charging infrastructure for EVs. In the European Union, an objective is for charging stations to be placed 60 kilometres apart between highways, supporting long-distance driving for EV owners with ease. In America, America’s Biden administration committed $7.5 billion towards developing a national EV charging infrastructure, with 500,000 public chargers installed target in 2030.

China has also taken a long distance in developing one of the biggest charging networks in the world, with both urban and rural communities having access to charging infrastructure for EVs. Homeowners and companies have even been encouraged with incentives for having private charging infrastructure installed, in a move to switch to electrified mobility.

Corporate and Fleet Incentives

Governments also provide incentives to fleet operators and companies to encourage the uptake of electric transport. Many companies operate large fleets of vehicles for deliveries, transportation, and other business needs. While the use of EVs can reduce operational costs and carbon emissions over the long run, the high initial outlay can be daunting.

To counter this, governments offer grants and subsidies to companies for the purchase of electric fleets. For example, in America, businesses that invest in EVs are eligible for federal tax credits, while in Europe, several funding programs have been launched to encourage commercial fleet electrification. India’s Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme offers financial incentives for electric buses, taxis, and delivery trucks.

Some governments mandate companies to shift to EVs gradually under clean energy policies. For example, California has made it compulsory for all new commercial vehicles sold after 2035 to be electric, to push companies to invest in EV fleets now.

Policy and Emission Controls

Beyond financial incentives, governments implement policies and legislation that compel both car buyers and producers towards EVs. Several countries have ambitious timelines for transitioning off ICE cars in a matter of a decade or two. Norway, for one, will stop new sales of gasoline and diesel cars in 2025, and the European Union proposed a 2035 outright ban for ICE car sales. All such policies send a strong message to car buyers and producers that the future for cars will be electric.

Stricter emission controls compel car manufacturers to make a larger proportion of EVs in order to satisfy government requirements. In places such as California, car manufacturers have to sell a proportion of zero-emitting cars in order to abide by environmental legislation. There are similar controls in China and in Europe, with car manufacturers incurring financial penalties for not satisfying carbon-cut targets.

Challenges and Criticism of Government Incentives

Despite their success, incentives for purchasing EVs have not been free of controversy and criticism and have been criticized and condemned for disproportionately benefiting wealthier buyers who can already afford an EV, not less wealthy buyers who can hardly even purchase an EV even with incentives. Others have criticized incentives for not being fiscally prudent in the long run, with governments having to make ends and spend wisely.

Another challenge is incentives’ potential curtailment or phasing out with growing EV demand. As incentives were initially adopted to stimulate the EV market, with growing demand, countries have started curtailing financial incentives. For instance, China has phased out EV subsidies over a period, causing sales to slow temporarily. Policymakers have to tread carefully in balancing incentives in a manner that promotes continued expansion but not at the expense of market steadiness.

The Future of Government Incentives for Electric Vehicles

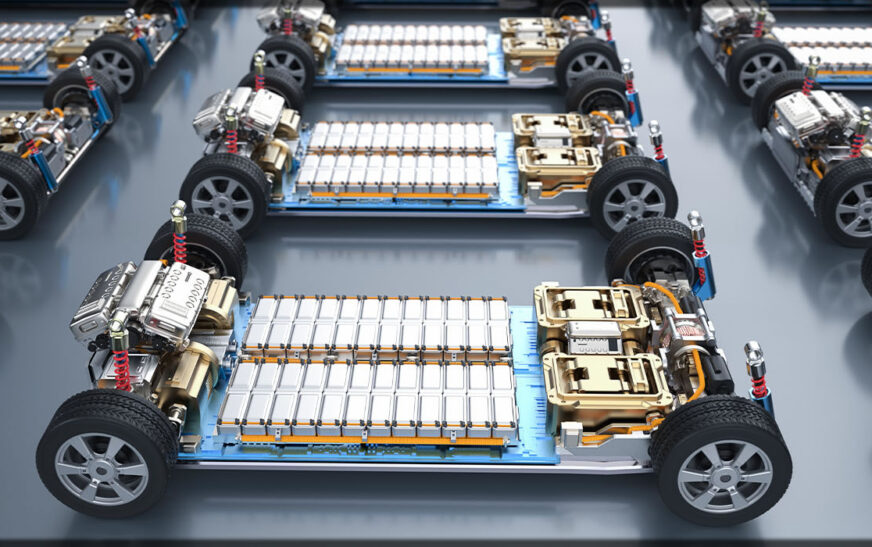

As the technology of EVs advances and the cost of production decreases, government incentives can shift towards the expansion of infrastructure, research funding, and support for battery technologies. Focus can also shift towards making EVs affordable to less affluent segments and encouraging the electrification of public transport and heavy-duty vehicles.

Many governments even have long-term strategies in mind such as augmented integration of renewable sources, promotion of EV battery recycling, and grid infrastructure development for supporting the widespread use of EVs. With a growing global momentum towards becoming carbon-neutral, new incentives and policies will soon develop for a quick transition towards electric mobility.

Conclusion

Government incentives have played a critical role in driving demand for EVs through lowered pricing, increased charging infrastructure and getting companies to opt for cleaner forms of transportation. Despite deterrents, ongoing government support will be important in driving continued growth in the EV market. As technology keeps improving and economies of scale in production become a reality, incentives will most likely move towards long-term viability, technological advancement, and availability for all sections of society for EVs. By providing a supportive environment for EV acceptance, governments can drive a cleaner, cleaner future for transportation.