What You Need to Know About EV Tax Credits and Rebates. As electric vehicles (EVs) gain popularity, governments worldwide are offering tax credits and rebates to encourage consumers to switch from gasoline-powered cars to more sustainable electric options. These financial incentives help lower the cost of purchasing an EV, making them more accessible to a broader audience. Understanding how these tax benefits work, who qualifies, and how to claim them is essential to maximizing savings and making an informed decision when purchasing an electric vehicle.

Understanding EV Tax Credits

An EV tax credit is a government incentive that reduces the amount of federal income tax you owe when you purchase a qualifying electric vehicle. Unlike a tax deduction, which lowers your taxable income, a tax credit directly reduces your tax bill. For instance, if you qualify for a $7,500 tax credit and owe $6,000 in federal taxes, the credit will eliminate your tax liability. However, if you owe less than the credit amount, you will not receive the difference as a refund, as this credit is non-refundable.

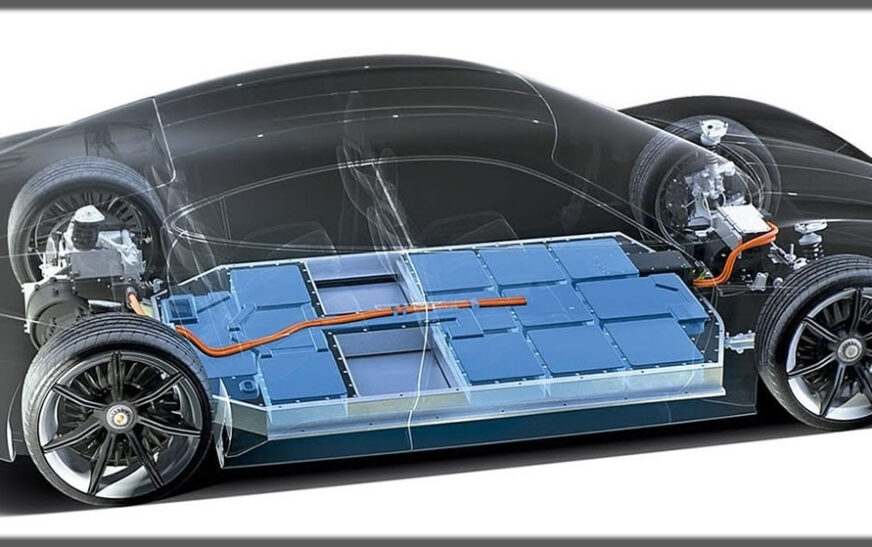

Under the Inflation Reduction Act (IRA) of 2022, the maximum federal EV tax credit is $7,500 for new electric vehicles and $4,000 for used EVs. The actual credit amount depends on factors such as the type of vehicle, battery composition, final assembly location, and the buyer’s income level.

Federal EV Tax Credit Requirements

To qualify for the full $7,500 tax credit on a new EV, the vehicle must meet several conditions. The battery components must be sourced from North America or a U.S. free trade partner. The final assembly of the vehicle must take place in North America. Additionally, price caps apply, with passenger cars needing to be priced below $55,000 and SUVs, trucks, and vans below $80,000. Income limits also determine eligibility, with a maximum income cap of $150,000 for single filers, $225,000 for heads of households, and $300,000 for joint filers.

Used EVs also qualify for a tax credit of up to $4,000, but they must be at least two years old, purchased from a licensed dealer, and have a selling price below $25,000. The credit is 30% of the purchase price, capped at $4,000. Income limits for used EV buyers are set at $75,000 for single filers, $112,500 for heads of households, and $150,000 for joint filers.

Understanding EV Rebates

Unlike tax credits, which are applied when filing income taxes, EV rebates provide direct savings at the time of purchase or shortly afterward. Many state and local governments, as well as utility companies, offer rebates that can significantly reduce the upfront cost of an EV. For example, if your state provides a $2,000 rebate, you can apply it directly to the purchase price, lowering the amount you need to finance or pay out of pocket.

State and Local EV Incentives

In addition to federal tax credits, many U.S. states offer additional rebates and incentives to promote EV adoption. California’s Clean Vehicle Rebate Project (CVRP) provides up to $7,500 in rebates, while Colorado offers a $5,000 state tax credit. New York provides a $2,000 rebate through its Drive Clean Rebate program, and New Jersey exempts EVs from state sales tax, further reducing costs. Other states, such as Oregon, offer up to $7,500 in combined rebates, making EV ownership even more attractive.

To find out what incentives are available in your state, it is recommended to visit the Department of Energy’s Alternative Fuels Data Center or your local government website for up-to-date information.

How to Claim EV Tax Credits and Rebates

To claim the federal EV tax credit, you must first ensure that your vehicle qualifies under the latest eligibility guidelines. After purchasing an eligible EV, it is important to keep all relevant documentation, including receipts and proof of eligibility. When filing your tax return, you must include IRS Form 8936 to claim the credit. If your state offers rebates, you may need to apply separately through a government agency or utility company, depending on the program requirements.

Starting in January 2024, the federal government introduced a point-of-sale benefit, allowing buyers to apply the tax credit directly at the dealership instead of waiting until tax season. This change makes EVs more affordable upfront, reducing the financial burden on buyers.

Additional Perks of EV Ownership

Beyond tax credits and rebates, many states and municipalities offer additional incentives for EV owners. Some states allow EVs to use high-occupancy vehicle (HOV) lanes even with a single driver, providing a significant advantage during peak traffic hours. Other perks include reduced vehicle registration fees, free or discounted public charging, and lower toll rates for EV drivers.

Conclusion

EV tax credits and rebates play a crucial role in making electric vehicles more affordable. By understanding how these incentives work, who qualifies, and how to claim them, buyers can maximize their savings and make a more informed decision when transitioning to an EV. With the 2024 point-of-sale option, purchasing an EV has become even more accessible, as buyers can now benefit from immediate price reductions. Before purchasing an EV, it is essential to check the latest federal, state, and local incentives, as regulations and eligibility requirements frequently change.